Effective management of financial affairs is critical to the success of any small business; therefore, mastery of the Accounts Receivable Aging Report is crucial. This report is literally the power tool that allows you to manage and track the number of dollars owed by your customers to you on various invoices. Your ability to read and interpret the report will help to maintain a healthy cash flow in any business.

The Accounts Receivable Aging Report classifies outstanding invoices by the number of days since their date. This classification makes it easier for business owners to distinguish which invoices are overdue and for how long, thus enabling them to follow up on these first. Knowing whom to call and when can greatly improve chances of collecting dues promptly.

That is to say, it will look into what an accounts receivable aging report means, why it is essential for your business and how effective its application would keep your business financially strong. On knowing where you stand on your accounts receivables, you make better decisions, manage cash flow in effect and ensure that the financial viability of your business is sustainable over the long run.

What is Accounts Receivable Aging Report?

An accounts receivable aging report is a simple but very important tool for every business. It shows how long customers have taken to pay their invoices. The report groups unpaid invoices by time periods like 0–30 days, 31–60 days, 61–90 days, and over 90 days. This helps business owners quickly see which customers owe money and how long the payments have been delayed.

By looking at the report, you can find out which invoices are overdue and need follow-up. It also helps you decide where to focus your efforts to collect money faster. This is helpful for improving your cash flow and keeping your business running smoothly.

If some payments are very late, the report can also warn you of possible bad debts. That way, you can take action early and avoid financial loss.

Checking the accounts receivable aging report regularly gives you a clear picture of how healthy your credit sales are. It’s more than just a report, it’s a smart way to stay on top of your money.

And if you’re wondering about the accounts receivable definition, it simply means the money your customers owe you for goods or services you’ve already provided but haven’t been paid for yet.

Why is the AR Aging Report Important?

It identifies late pays: With an Accounts Receivable Aging report, it becomes very clear which of the customers are not paying attention to their terms concerning payment. It is quite apparent why cash flow is the lifeblood of the small business because recognizing which invoices are due creates the opportunity to take immediate action in the form of sending reminders or making phone calls to retrieve funds on time and keep healthy cash flow.

Helps in Risk Management : Since small businesses would always examine the Accounts Receivable Aging Report, they would thus identify the payment behavior patterns. Among the patterns would include customers who always pay late. This information is very sensitive in assessing credit risk. For instance, if business presents its customers as chronic payers, then it would change its credit terms or demand pre-payments thus reducing the risk of bad debts and consequently business’s financial stability.

Helps Simplify the Customer Relationship Management Process: The knowledge of how various customers pay can enable the business organization to work out various types of communications properly. The Accounts Receivable Aging Report will mean when to issue the polite payment reminder or when to make follow-up calls, which ensures that communications happen on time and properly. This move in advance does not only ensure that the collection of dues is efficient but also plays a role in maintaining good customer relationships, as the communications are dealt with professionally.

Helps During Financial Audits: Keeping your accounts receivable records updated is very helpful during financial audits. Auditors, banks, or investors want to see that your records are correct. A clean and organized accounts receivable aging report builds trust and shows that your business is handling money well.

You might wonder, is accounts receivable an asset? Yes, it is! It’s called a current asset because it’s money your business is expecting to receive soon from customers.

Also, this report helps you track your accounts receivable turnover ratio. This is an important number that shows how quickly your business collects payments. A higher ratio means you’re collecting money faster, which is a very good sign for your company’s health and future growth.

How to Effectively Use the AR Aging Report

Periodic Review

As you continue with your financial management practice, make a habit of regularly reviewing the Accounts Receivable Aging Report; doing so weekly or monthly will be ideal. With regular reviews, you will keep updating on the status of receivables and hence come at a position where you would address overdue accounts readily. You being in control of these receivables makes you recognize problems with cash flow before they turn out to be more serious.

Follow up promptly

Use the Accounts Receivable Aging Report to identify every late-paying customer and contact them immediately. The prompt follow-up through reminders in the form of email or phone calls is of great importance since it significantly enhances the likelihood of collecting the dues. In addition, timely reminders can maintain a positive relationship with the customer and reduce the possibilities of bad debts.

Analyze Customer Payment Patterns

You can learn many crucial details about the behavior and traits of your customers from the analysis of payment patterns. For instance, when the account receivable’s aging report indicates that some customers consistently pay late, it may be prudent to modify the credit terms for them. You may require getting pre-payments or shorter payback periods for any future order so that the risk as well as cash flow gets improved by reducing the risk.

Receivables Focus

Here, data in the Accounts Receivable Aging Report must be taken into account during the prioritization of collection efforts. The oldest of debts will often prove to be the toughest to collect and therefore must take the highest rank. In a concurrent process, the larger outstanding balances should be watched closely as they will inevitably impact total cash flow.

Utilize Automated Reminders

To make your work more efficient, you may want to obtain accounting software that could send automatic reminders to customers. Automated reminders mean staying constantly in touch with your customers about their overdue payments, significantly lessening the possibility of missing a single account. It may result in greater on-time payments and fewer receivables slipping through the cracks.

Train Your Team

Ensure proper training of the finance team to interpret and act on the information yielded by the Accounts Receivable Aging Report. Proper training will ensure that the member of your finance team realizes the need for receivables and also acquires the skills required to manage it properly. Any training should include a strategy for approaching the customers in case of collections and also a method for maintaining professionalism and tenacity without harming the relationship with your customer.

Review credit policies

Regular points from the Accounts Receivable Aging Report are also useful in monitoring and refining your credit policies. For example, when there are more receivables that have aged for more than 90 days, it may serve as an indicator that you need to readjust your credit terms. Adjusting your policy based on actual data will help prevent future problems with your receivables while stabilizing your business finance.

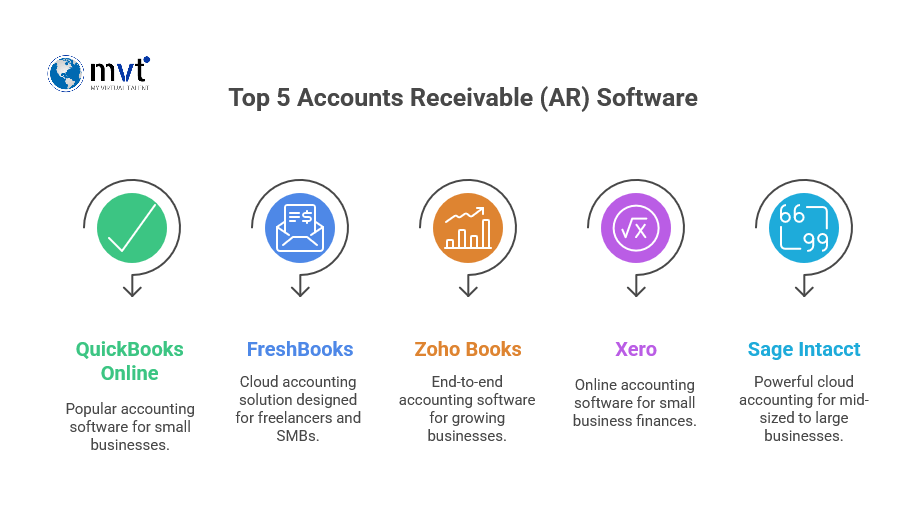

Top 5 Accounts Receivable (AR) Software

Managing accounts receivable can be time-consuming. Thankfully, there are many great software tools that help small and large businesses keep track of invoices and get paid faster. Here are the top 5 accounts receivable (AR) software options:

1. QuickBooks Online

QuickBooks is one of the most popular accounting tools. It lets you send invoices, track due payments, and follow up with customers easily. It’s great for small to medium businesses and is very user-friendly.

2. FreshBooks

FreshBooks is perfect for freelancers and small businesses. It offers simple invoicing, payment tracking, and even late payment reminders. It’s easy to set up and use.

3. Zoho Books

Zoho Books is part of the Zoho suite and offers strong invoicing, payment tracking, and financial reporting tools. It’s budget-friendly and great for growing companies.

4. Xero

Xero is a cloud-based software known for its clean interface and strong features. It lets you manage AR, connect bank accounts, and send invoices on the go.

5. Sage Intacct

This tool is best for bigger companies that need detailed reports and strong automation. Sage Intacct offers advanced features like payment scheduling and AR analytics.

These tools save time, reduce mistakes, and help you get paid faster. Choosing the right software can improve your cash flow and make managing your business much easier.

Conclusion

Understanding and using the Accounts Receivable Aging Report is one of the simplest but most powerful ways to keep your small business healthy. This report shows you who owes you money and how long they’ve owed it. That helps you act quickly before payments become too late or turn into bad debts.

The report also helps you keep your cash flow steady. Knowing which customers need reminders lets you follow up at the right time. Over time, this builds better habits with your customers and helps your business run more smoothly.

It also helps you spot risk. If you notice the same customers paying late every time, you can think about changing your payment terms or asking for payments in advance. This protects your business and keeps your finances strong.

Using this report regularly gives you a full view of your finances. It helps you make smart choices, grow your business, and stay ahead of problems before they get too big.

If you need help creating or managing your Accounts Receivable Aging Report, the team at MyVirtualTalent is here to help. We offer expert support to keep your reports clear, updated, and useful.

Looking for fresh content?

Get articles and insights from our weekly newsletter.

Recent Posts

Reduce Your Marketing Spend By 70% And Grow Your Revenue Organically 10X Faster!

Get a Free Quote Today!