Hire Payroll Experts

Outsource Payroll Services for streamlined and accurate payroll management. Our dedicated team handles payroll processing, tax compliance, and employee compensation, ensuring your business stays focused on growth while we take care of payroll intricacies.

Start Building Your Dedicated Team for as Low as US $399/Month

Choose Candidates Freely After Interviews

No Commitment to Long-Term Contracts or Employee Obligations

Collaborate Across Worldwide Time Zones

Hire Payroll Experts

Why Choose India for Payroll Processing Services?

Reduce stress associated with payroll and related procedures, stay out of trouble, and save as much money as possible.

Although processing payroll is a vital part of any business, it may take a lot of time. Depending on how employee wages are set up, payroll may be produced weekly, semi-monthly, or monthly.

Many businesses use Indian payroll specialists to handle their payroll needs in order to make the process simple and painless. Payroll processing businesses in India handle a variety of duties, including managing direct payments, tax requirements, and salary report administration. Outsourcing payroll for small businesses significantly lowers a company's operational costs.

Complete Payroll Services for Small and Medium Businesses

Adherence to all current rules and regulations

Complete payroll support for your staff

A combined 50+ years of subject-matter experience

Why Outsource Services for Payroll Processing?

Benefits of Outsourcing Payroll to India

services

General Ledger Reporting for Payroll

You get all the data required to produce the payroll journal entry for your general ledger when you contract with us for your payroll general ledger reporting services. This includes the calculation of all data pertaining to employee payroll.

Benefits of My Virtual Help Outsourcing's Offshore Payroll Services

Not only do we take great pride in the quality of our payroll processing services, but so do our customers.

Secure Data Processing

Your financial information is completely private, as we guarantee. We utilise a secure FTP server, sign NDAs with our staff, and take numerous more steps to protect your data.

Leave Tax Penalties Behind

Your taxes will always be accurately completed and punctually filed with My Virtual Help' Payroll Expert, and they will make sure you adhere to all applicable State and Federal rules.

The deadline was met.

Without deadlines, there are no headaches. The greatest way to make sure your business runs like a well-oiled machine and meets all of its objectives is to engage expert outsourcing services.

Effortless Communication

Now there will be no misunderstandings or communication problems with your offshore virtual employee. At My Virtual Help, hire payroll professionals that are competent in English.

Zero Administrative Fees

You may avoid paying the overhead expenses associated with employing an on-site employee, such as salary, bonuses, location, refreshments, taxes, health insurance, retirement, vacations, etc. by outsourcing.

Customized options

Our payroll processing team produces a lot of work. They have more than 25 years of expertise in all aspects of Payroll-related operations, so they can easily satisfy any of your unique needs.

Support and Maintenance

My Virtual Help remote personnel continuously assist and maintain your company to provide the greatest return on investment and the highest level of customer satisfaction for our customers.

Free Trial and Refund Promise

We provide free trials so you may check out our calibre at your convenience. Although we are confident in the quality of our services, we provide a money-back guarantee to give you peace of mind.

Our Process for Managing Payroll

The 3-step payroll processing technique that your VE Payroll professional uses is comprehensive.

1. How to Determine Employee Pay

Obtaining the employee's EIN

Creating local or state tax IDs

Gathering tax and financial data from employees

1099 and W-4 forms

Deciding on the best payroll schedule for your company.

Establishing a payroll schedule.

Deciding when to pay taxes.

2. Processing Payroll Manually

Keeping track of employee hourly schedules

Figuring out overtime pay

Figuring up gross pay

Calculating deductions

Determining net pay

The problem with employee payments, such as paper checks and direct deposits.

3. After Pay Day, What Comes Next?

Keeping track of payroll records

Verifying possible computations and inaccuracies by cross-checking

Notifying the IRS of new employees

Reduce upto 70% of your costs with MVT Outsourcing

Our clients save over $10,500,000/ Yr

Using our unique virtual employee business model, you pay no overhead costs.

Request A Free Consultation

Testimonial

Check Out What Clients Say

Our clients include software development companies, app makers, e-commerce platforms, edtech solutions,

branding services, pharmaceutical companies and many more. (Our clients logo infographic)

In the last few years, we have created a variety of applications with strategic significance that have required specific skills at the last minute. MVT has been working together with us to obtain temporary resources for a short period of time. They are aware of the types of resources we require and how to integrate them within our team.

Adam Moe

Owner-Rainbow PropertiesThe Virtual Assistants that MyVirtualTalent offered helped us to achieve significant savings in time and cost on a variety of difficult projects. Their prompt response to our needs and care for detail is exceptional. quotes-right.

Erica Kelley

CEO-Erica Kelley GroupI am so happy with the SEO and website maintenance service that MyVirtualTalent provides. My website is always running smoothly and is getting great traffic. The SEO service has been a great help in getting my website ranked high in search engines. I highly recommend MyVirtualTalent to anyone who needs help with their website.

Sam Alshaer

CEO- Prudential W LendingI was hesitant about hiring Indian developers until MyVirtualTalent changed my mind. Their approach perfectly supported our project, offering a versatile remote team skilled in Data Analytics, Marketing Automation, PHP, IT, Design, Android, and more, all at 75% less cost than local rates.

Bryn Bradley

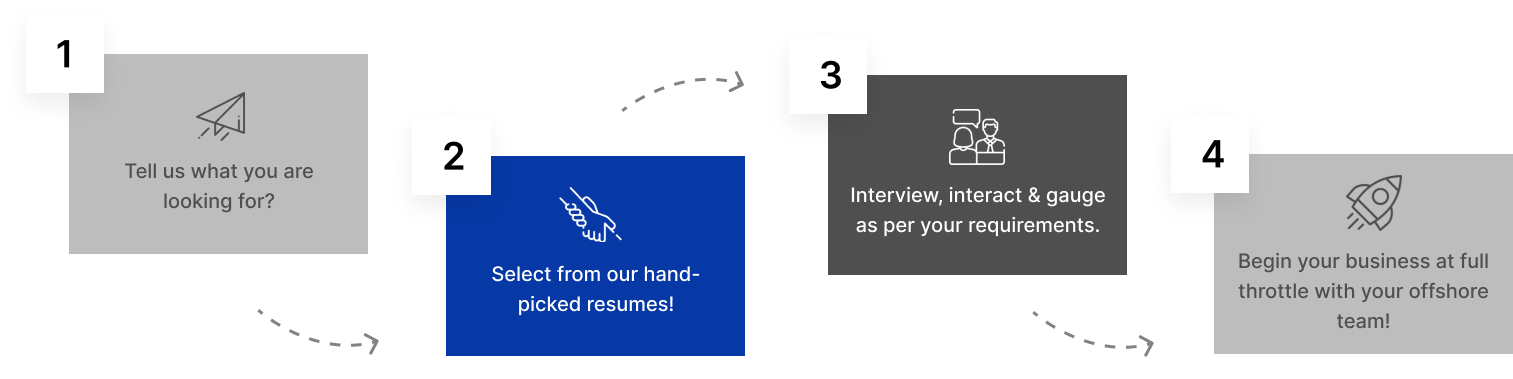

Chiropractor - Alta VistaPROCESS OF HIRING

Here’s How You Can Pick the MASTERS of

All Domains!